As at the beginning of the year Addison Company’s assets are a critical component of its financial well-being, providing a foundation for understanding the company’s overall financial health. This comprehensive analysis delves into the nature of assets, their significance for Addison Company, and their impact on the company’s financial performance.

Addison Company’s assets, categorized into current and non-current groups, play a pivotal role in the company’s day-to-day operations and long-term growth strategies. Current assets, such as cash and accounts receivable, provide liquidity and support short-term obligations, while non-current assets, like property, plant, and equipment, contribute to the company’s long-term earning potential.

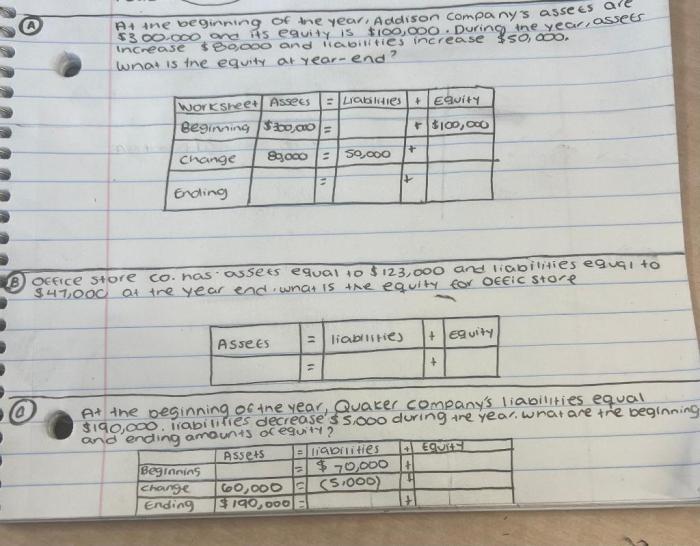

Assets at the Beginning of the Year: At The Beginning Of The Year Addison Company’s Assets Are

Assets are resources owned or controlled by a company that have economic value and can be converted into cash or used to generate income. They represent the company’s financial strength and stability and are essential for its operations.

Common types of assets include cash, accounts receivable, inventory, property, plant, and equipment. Assets can be classified into two main categories: current assets and non-current assets. Current assets are expected to be converted into cash within one year, while non-current assets are expected to be held for longer than one year.

The valuation of assets is important for financial reporting and decision-making. Various methods are used to determine the value of assets, including historical cost, market value, and fair value.

Addison Company’s Assets

At the beginning of the year, Addison Company held the following assets:

- Cash: $100,000

- Accounts receivable: $200,000

- Inventory: $300,000

- Property, plant, and equipment: $500,000

These assets can be categorized as follows:

- Current assets: Cash, accounts receivable, inventory

- Non-current assets: Property, plant, and equipment

The current assets constitute a significant portion of Addison Company’s total assets, indicating that the company has a high level of liquidity and is able to meet its short-term obligations.

Financial Statement Presentation

Assets are typically presented on a company’s balance sheet, which provides a snapshot of the company’s financial position at a specific point in time. Assets are listed in order of liquidity, with the most liquid assets appearing first.

Addison Company’s assets would be presented on its balance sheet as follows:

| Asset | Amount |

|---|---|

| Cash | $100,000 |

| Accounts receivable | $200,000 |

| Inventory | $300,000 |

| Property, plant, and equipment | $500,000 |

| Total assets | $1,100,000 |

Accurate and transparent asset disclosure is essential for investors and other stakeholders to assess a company’s financial health and make informed decisions.

Impact on Financial Analysis

The analysis of assets can provide valuable insights into a company’s financial health. Financial ratios that incorporate asset data include:

- Current ratio: Measures a company’s ability to meet its short-term obligations

- Quick ratio: Measures a company’s ability to meet its short-term obligations without relying on inventory

- Asset turnover ratio: Measures how efficiently a company uses its assets to generate sales

Changes in asset levels can also affect a company’s financial performance and risk profile. For example, an increase in inventory levels may indicate that the company is facing difficulties in selling its products, while a decrease in cash levels may indicate that the company is struggling to meet its obligations.

FAQ Explained

What are the key types of assets held by Addison Company?

Addison Company holds various assets, including cash, accounts receivable, inventory, property, plant, and equipment.

How are Addison Company’s assets classified on its balance sheet?

Addison Company’s assets are classified into current assets and non-current assets on its balance sheet.

What is the significance of asset analysis for investors and creditors?

Asset analysis helps investors and creditors assess a company’s liquidity, solvency, and overall financial health.